Long Term Capital Gains Tax Rate 2025 Table 2025 2025

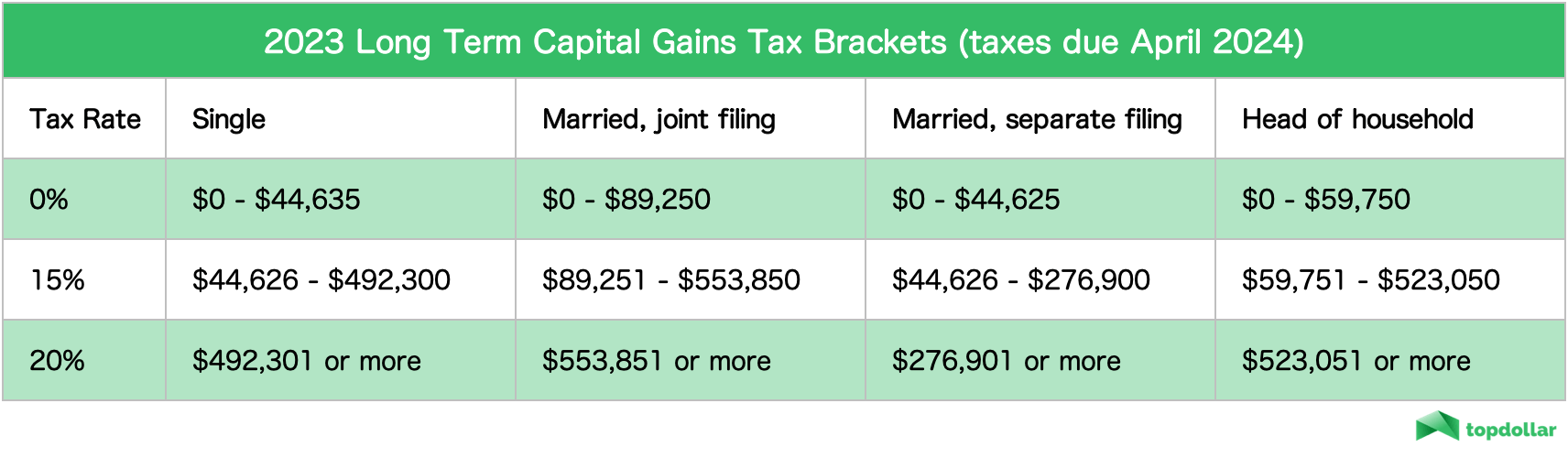

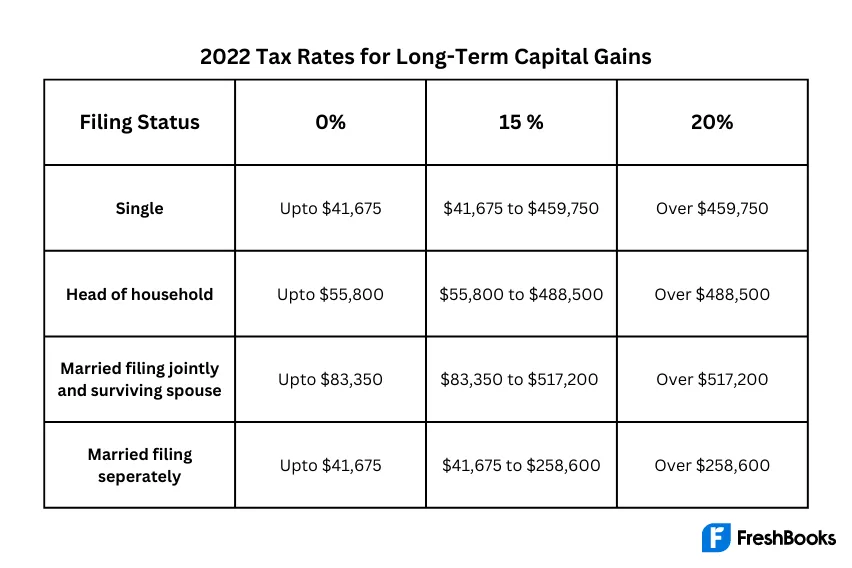

Long Term Capital Gains Tax Rate 2025 Table 2025 2025. Based on filing status and taxable. Capital gains tax rates for 2023.

When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. Single tax filers can benefit.

The Stcg (Short Term Capital Gains) Tax Rate On Equity Funds Is 15%.

The rates are 0%, 15% or 20%, depending on your taxable income.

Generally, These Rates Are More Favorable Compared To.

Single filers can qualify for the.

Long Term Capital Gains Tax Rate 2025 Table 2025 2025 Images References :

Source: pheliawbryna.pages.dev

Source: pheliawbryna.pages.dev

Capital Gains Tax 2025 Budget Sher Ysabel, The asia trade brings you everything you need to know to get ahead as the trading day begins in asia. Here's how budget 2025 can simplify capital gains tax for investors.

Source: jeriqnollie.pages.dev

Source: jeriqnollie.pages.dev

Long Term Capital Gains Tax Rate 2025 Nys Essie Jacynth, The stcg (short term capital gains) tax rate on equity funds is 15%. The asia trade brings you everything you need to know to get ahead as the trading day begins in asia.

Source: imagetou.com

Source: imagetou.com

Capital Gains Rate 2025 Table Image to u, The stcg (short term capital gains) tax rate on equity funds is 15%. The rates are 0%, 15% or 20%, depending on your taxable income.

Source: carissawtilda.pages.dev

Source: carissawtilda.pages.dev

Long Term Capital Gains Tax Rates 2025 Gerti Juliane, The ltcg (long term capital gains) tax rate on equity funds is 10% on ltcg exceeding. The stcg (short term capital gains) tax rate on equity funds is 15%.

Source: ettiqmarina.pages.dev

Source: ettiqmarina.pages.dev

Capital Gains Tax Federal 2025 Amber Bettina, Single filers can qualify for the. High income earners may be subject to an additional.

Source: imagetou.com

Source: imagetou.com

Changes To Capital Gains Tax 2025 Image to u, Single tax filers can benefit. Long term capital gains (ltcg) tax:

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

ShortTerm And LongTerm Capital Gains Tax Rates By, Here's how budget 2025 can simplify capital gains tax for investors. Capital gains tax rates for 2023.

Source: tomaqletitia.pages.dev

Source: tomaqletitia.pages.dev

Capital Gains Tax Brackets 2025 Devin Marilee, Based on filing status and taxable. The asia trade brings you everything you need to know to get ahead as the trading day begins in asia.

Source: www.freshbooks.com

Source: www.freshbooks.com

Capital Gains Tax Definition & Calculation, When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. Capital gains tax rates for 2023.

Source: guidedcitypass.com

Source: guidedcitypass.com

Capital Gains Tax Brackets For 2023 And 2025 Capital Gains Tax, Single tax filers can benefit. High income earners may be subject to an additional.

Capital Gains Taxes Can Range From 10 Per Cent To As High As 30 Per Cent, Depending On The Holding Period, Which Spans From One To Three Years.

Remember, this isn't for the tax return you file in 2025, but rather, any gains you incur.

Generally, These Rates Are More Favorable Compared To.

Single tax filers can benefit.

Posted in 2025